Are Homebuyers Getting Used to Today's Mortgage Rates?

Before you decide to sell your house, it's important to know what you can expect in the current housing market. One positive trend right now is homebuyers are adapting to today's mortgage rates and getting used to them as the new normal.

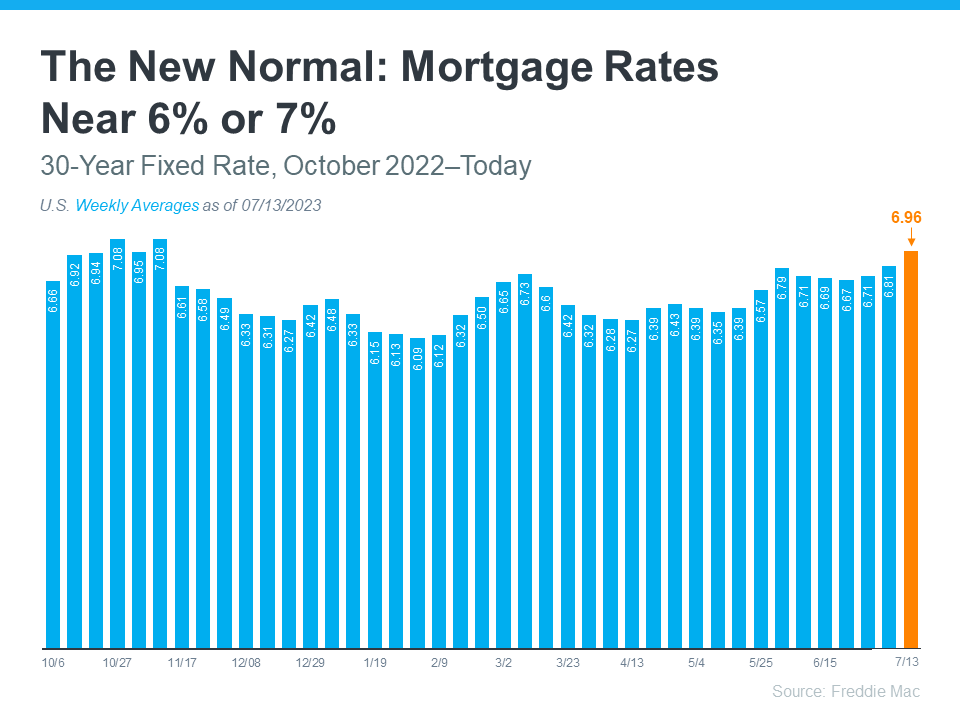

To better understand what's been happening with today's mortgage rates, the graph below shows the trend for the 30-year fixed mortgage rate from Freddie Mac since last October. As you can see, rates have been between 6% and 7% pretty consistently for the past nine months:

Mortgage rates play a significant role in buyer demand and, by extension, home sales. They heavily influence the direction of home sales and because of relatively steady rates over the last number of months home sales have stayed consistent.Â

As a seller, hearing that home sales are consistent right now is good news. It means buyers are out there and actively purchasing homes. Here's a bit more context on how mortgage rates have impacted demand recently.

When mortgage rates surged dramatically last year, escalating from roughly 3% to 7%, many potential buyers felt a bit of sticker shock and decided to hold off on their plans to purchase a home. However, as time has passed, that initial shock has worn off. Buyers have grown more accustomed to today's mortgage rates and have accepted that the record-low rates of the last few years are behind us. Homeowners and homebuyers are accepting the idea that higher mortgage rates will likely stick around for the near future. Â

In fact, a recent survey by Freddie Mac reveals 18% of respondents say they're likely to buy a home in the next six months. That means nearly one out of every five people surveyed plan to buy in the near future. And that goes to show buyers are planning to be active in the months ahead.

Of course, today's mortgage rates aren't the sole factor affecting buyer demand. No matter where mortgage rates stand, people will always have reasons to move, whether it's for job relocation, changing households, or any other personal motivation. As a seller, you can feel confident there is a market for your house today. And that demand is pretty strong as buyers settle into where rates are right now.Â

The way buyers perceive today's mortgage rates is shifting  they're getting used to the new normal. Steady rates are contributing to strong buyer demand and consistent home sales. If you think you're ready to start a conversation about buying your next home, Butler Mortgage is here to be your trusted partner in the process. Contact us today or read our blog on the top tips for getting approved for a mortgage as you prepare for this next move.